Property taxes are not the main source of funding for California schools, despite what people think. The biggest source is personal income taxes, especially on the state's wealthiest taxpayers.

Communities in California have very limited options for raising local revenue for schools. Other states differ in this way.

The amount per pupil your district gets is mostly driven by the rules of the Local Control Funding Formula (LCFF).

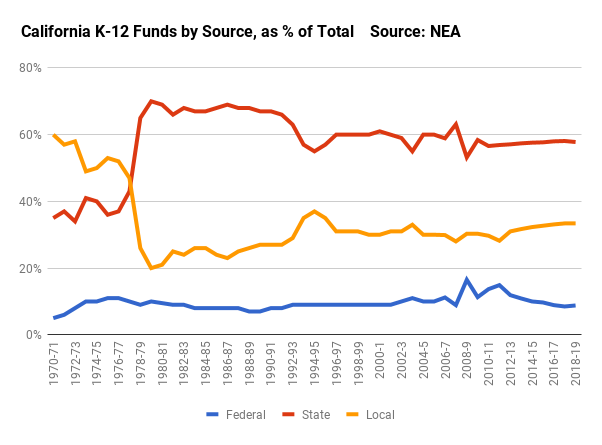

Until the late 1970’s, schools in California were predominantly funded by local property taxes, as in most other states. The most basic function of a school board was to set the local property tax rate. Rates varied among districts, and receipts varied according to both the tax rate and the "assessed" (taxable) value of homes and commercial properties being taxed. Assessing the taxable value of property was an important function of county assessors.

This arrangement was great for property-rich districts, but rotten for communities with low assessed values and lots of students. Those communities had to set very high property tax rates in order to provide schools with as much money per student as their more fortunate counterparts. The Serrano v. Priest case successfully challenged this arrangement. Is it really fair, the case asked, that some districts can tax themselves at a lower level and still enjoy more funding per student than others? After all, kids have no say in the wealth of their parents. The case led to court-mandated "revenue limits," which were meant to equalize funding per student at the district level over time.

Over a period of years the state gained nearly full power over education funding. The state legislature and governor determine what portion of the budget would go to the education system, and how that portion would be distributed to local school districts. As the state became the center of power, school boards, once powerful and independent, were left with the narrower job of playing the hand dealt to them by fate and the state.

California’s skimpy funding for schools today is arguably the long-term outcome of the shift from a locally-dominated funding system to a state-dominated one. Funding for schools in 1970 required an expression of local political will in the form of a vote of the locally elected school board or a local ballot measure. Taxpayers in each community had to reach agreement to shoulder taxes on behalf of the children in their own local school district. Though politically difficult, districts could change property tax rates in response to school needs, local changes in property values, or local tolerance for taxes.

Local Schools, Centralized Funding

Today, the responsibility for funding schools falls mostly on the state. Changes in school funding largely depend on statewide political support for increasing taxes to add resources for all schools. That kind of support has proven difficult to win. Developing the necessary political will to pass a tax measure is hard even in a small town; in a state as large as California it is very hard indeed. The old system was unacceptably inequitable, but it was certainly better at raising money in total.

No comments:

Post a Comment